1. Consumption growth and dominance of thermal energy

- Within the next 20 years, the primary energy demand is going to rise by 40% while the electricity consumption will soar by 70%.

- More than 90% of our primary energy and 80% of the electricity generation is coming from sources which involve a thermal process to be used (ie: fossil fuels, nuclear, CSP, biomass, geothermal energy). This share is expected to remain stable in the near to long-term future.

|

| Click to enlarge the figure |

|

| Click to enlarge the figure |

Source:

- OECD IEA 2011 World energy outlook, see also the 2011 Key world energy Statistics

- US EIA 2011 International energy outlook, see also the Statistics page

- OECD IEA 2011 World energy outlook, see also the 2011 Key world energy Statistics

- US EIA 2011 International energy outlook, see also the Statistics page

2. Oil crunch and economic impact

WARNING: The oil “peak” is a controversial concept. For the past 30 years, many people have predicted “the end of the oil age”, end that was supposed to happen soon and be cataclysmic… Although we are not qualified to answer this question, recent elements are suggesting that the oil supply is under strong pressure. It is now commonly accepted by experts and oil industry leaders that the end of cheap oil is becoming real.

"The cost of bringing oil to market rises as oil companies are forced to turn to more difficult and costly sources to replace lost capacity and meet rising demand. Rising transport demand and upstream costs reconfirm the end of cheap oil" International Energy Agency - World Energy Outlook November 2011

"The cost of bringing oil to market rises as oil companies are forced to turn to more difficult and costly sources to replace lost capacity and meet rising demand. Rising transport demand and upstream costs reconfirm the end of cheap oil" International Energy Agency - World Energy Outlook November 2011

- According to a projection in the 2010 World Energy Outook from the OECD International Energy Agency production of conventional crude oil (the black liquid stuff that rigs pump out of the ground) has probably peaked in 2006, at about 70 million barrels a day. Production from currently producing oil fields will drop sharply in coming decades, the report suggests. Meeting that additional demand will fall entirely on unconventional oil sources like Canada’s tar sands as well as increased production of natural gas liquids. A major boost in these energy sources should be able to meet demand, but that is far from certain, told Nobuo Tanaka, the agency’s executive director. Depending of the governments energy policies, this will drive oil prices over $200 to $240 ($113 to $135 in real dollars), a range we painfully visited briefly during the spring and early summer of 2008.

|

| World Oil Production (IEA WEO 2010) |

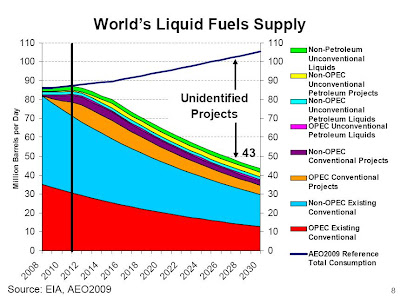

- However, the US Department of Energy (DOE) is less confident than the IEA about the world's capacity to supply unconventional fuel.

| |||

| What fuel supply could substitute for the conventional oil drop ? |

|

| Fatih Birol, IEA's Chief Economist |

- In November 2011, the IEA's Chief Economist Fatih Birol, following the 2011 IEW World Energy Outlook presentation says that without major increases in investment (an increasingly unlikely occurrence), Middle Eastern oil production will fall by 3.4 million barrels a day (b/d) by 2015 and 6.2 million by 2020. Should this happen, we will have oil prices in excess of $150 a barrel until of course demand slumps from the high prices.

- The US military has warned that there could be serious shortages by 2015 with a significant economic and political impact. The energy crisis outlined in a Joint Operating Environment report from the US Joint Forces Command, comes as the price of petrol reaches record levels and the cost of crude is predicted to soon top $100 a barrel."By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 million barrels per day," says the report, which has a foreword by a senior commander, General James N Mattis. Meanwhile, the US Air Force and the US Navy have been busy testing their aircraft on jet biofuel. Together with the Departments of Energy and Agriculture, the Navy has launched a project to invest up to half a billion dollars in biofuel refineries. Navy Secretary Ray Mabus says he is committed to getting 50 percent of the Navy's fuel for aircraft and surface ships from renewable sources by 2020 because dependence on foreign oil makes the U.S. military vulnerable. On December 2011, the US Defense Department has signed a contract to buy 450,000 gallons of biofuel, the largest purchase ever by the federal government

- Many other organizations have predicted high oil prices scenario in short to middle term due to the increasing difficulty in accessing oil (whether it's caused by geological or political factors): German DoD, Lloyd's insurance company, US DOE, UK industry taskforce, Petrobras's CEO, Shell, Former BP Chief Petroleum Engineer,etc.

3. The boom of renewable energy

- During the five-years from the end of 2004 through 2009, worldwide renewable energy capacity grew at rates of 10–60% annually for many technologies.

- Global investment in renewable energy jumped 32% in 2010, to a record $211 billion, up from $160 billion in 2009. The top countries for investment in 2010 were China, Germany, the United States, Italy, and Brazil.

- In 2010, renewable power consisted about half of the newly built power generation capacities (194 GW) while existing renewable power capacity worldwide reached an estimated 1320 GW in 2010, up almost eight percent from 2009.

- Renewables now comprise about a quarter of total global power generating capacity (estimated at 4950 GW in 2010) and supplies close to 20 percent of global electricity, with most of this provided by hydropower. When hydropower is not included, renewables reached a total of 312 GW in 2010, a 25 percent increase over the 2009 figure of 250 GW.

- Among all renewables, global wind power capacity increased the most in 2010, followed by hydropower and solar photovoltaics (PV).

- The share of non-hydro renewables in power generation increases from 3% in 2009 to 15% in 2035, underpinned by annual subsidies to renewables that rise almost five-times to $180 billion.

- A 2011 IEA report said: "A portfolio of renewable energy technologies is becoming cost-competitive in an increasingly broad range of circumstances, in some cases providing investment opportunities without the need for specific economic support," and added that "cost reductions in critical technologies, such as wind and solar, are set to continue."

4. Energy investments

- Large-scale investment in future energy supply is needed. $38 trillion in global investment in energy-supply infrastructure is required from 2011 to 2035, an average of $1.5 trillion per year ! Two-thirds of this is required in non-OECD countries. The power sector claims nearly $17 trillion of the total investment. Oil and gas combined require nearly $20 trillion, increasing to reflect higher costs and a need for more upstream investment in the medium and long term. Coal and biofuels account for the remaining investment.

- Global investment in renewable energy jumped 32% in 2010, to a record $211 billion, up from $160 billion in 2009. The top countries for investment in 2010 were China, Germany, the United States, Italy, and Brazil.

No comments:

Post a Comment